The Leading Features to Search For in a Secured Credit Card Singapore

The Leading Features to Search For in a Secured Credit Card Singapore

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Report Cards Following Discharge?

Navigating the economic landscape post-bankruptcy can be a difficult job for individuals wanting to reconstruct their credit rating. One typical inquiry that arises is whether former bankrupts can efficiently obtain bank card after their discharge. The answer to this query entails a multifaceted exploration of different variables, from charge card alternatives customized to this demographic to the impact of past economic choices on future creditworthiness. By comprehending the details of this procedure, individuals can make enlightened decisions that may lead the way for an extra protected economic future.

Understanding Bank Card Options

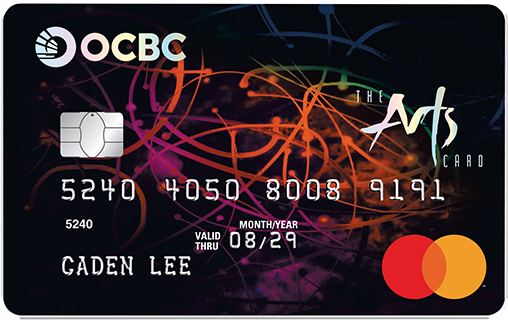

When thinking about credit report cards post-bankruptcy, people must carefully analyze their needs and monetary circumstance to select the most suitable option. Secured debt cards, for instance, call for a cash deposit as security, making them a practical option for those looking to restore their credit background.

Additionally, people must pay close interest to the annual percent price (APR), elegance duration, annual charges, and incentives programs offered by different credit report cards. By comprehensively assessing these aspects, people can make educated choices when picking a credit history card that lines up with their economic objectives and circumstances.

Factors Impacting Approval

When using for debt cards post-bankruptcy, understanding the elements that influence approval is important for people looking for to rebuild their economic standing. Adhering to an insolvency, credit rating ratings typically take a hit, making it more difficult to qualify for standard credit scores cards. Demonstrating accountable economic habits post-bankruptcy, such as paying bills on time and maintaining credit score application reduced, can also positively influence credit report card authorization.

Protected Vs. Unsecured Cards

Secured credit cards require a cash down payment as security, usually equal to the credit report limit expanded by the issuer. These cards generally supply higher debt limitations and reduced passion rates for people with great credit rating scores. Ultimately, the selection in between secured and unsecured credit cards depends on the person's financial circumstance and credit scores goals.

Building Credit Score Sensibly

To properly rebuild credit report post-bankruptcy, developing a pattern of responsible credit report usage is necessary. In addition, maintaining credit card balances reduced relative to the credit scores limit can positively affect credit score ratings.

Another method for building credit report sensibly is to keep an eye on credit report reports consistently. By examining debt reports for errors or indications of identification theft, people can attend to problems immediately and preserve the accuracy of their credit report. Furthermore, it is a good idea to abstain from opening numerous new accounts at the same time, as this can signal economic instability to potential lending institutions. Instead, emphasis on that site progressively diversifying credit history accounts and showing regular, responsible credit score actions gradually. By following these techniques, people can gradually restore their credit post-bankruptcy and job towards a healthier monetary future.

Enjoying Long-Term Perks

Having actually developed a structure of responsible debt management post-bankruptcy, individuals can currently concentrate on leveraging their boosted creditworthiness for long-lasting economic benefits. By continually making on-time settlements, keeping credit score utilization low, and monitoring their credit scores records for precision, previous bankrupts can progressively reconstruct their credit rating ratings. As their credit rating increase, they might come to be eligible for far better charge card supplies with reduced rate of interest and higher credit scores limits.

Reaping long-lasting take advantage of enhanced credit reliability expands beyond just credit score cards. It opens doors to beneficial terms on fundings, home mortgages, and insurance coverage costs. With a solid credit report history, individuals can discuss far better rate of interest on finances, possibly saving countless bucks in interest repayments gradually. Furthermore, a positive credit rating profile can improve work leads, as some companies might inspect credit reports as part of the employing procedure.

Final Thought

In final thought, previous insolvent individuals might have difficulty Click This Link securing bank card adhering to discharge, however there are choices available to help reconstruct credit rating. Recognizing the different kinds of charge card, variables impacting authorization, and the importance of accountable debt card usage can assist people in this scenario. By choosing the best card and utilizing it responsibly, previous bankrupts can gradually improve their credit rating and enjoy the long-lasting benefits of having accessibility to debt.

Showing accountable economic habits post-bankruptcy, such as paying costs on time and maintaining credit history usage reduced, can additionally positively influence credit report card authorization. In addition, maintaining credit card balances low loved one to the credit history limit can favorably impact credit rating ratings. By constantly making on-time payments, maintaining credit use reduced, and monitoring their credit records for accuracy, former bankrupts can progressively reconstruct their debt ratings. As their credit score find more scores boost, they may end up being eligible for better credit card provides with reduced interest prices and greater credit score limits.

Understanding the different types of credit rating cards, aspects affecting approval, and the value of liable credit report card use can aid people in this circumstance. secured credit card singapore.

Report this page